Alphabet, the parent company of Google, remains a powerhouse in the tech world, often underappreciated amid the market’s chase for flashier AI plays or high-growth stocks. While others grab headlines, Alphabet quietly delivers consistent results. Here’s why I believe $GOOGL is a compelling long-term investment.

A Business Built to Last

Google is synonymous with search, but Alphabet’s empire extends far beyond. They own YouTube, Android, Google Cloud, Gmail, Google Maps, Chrome, and more. These aren’t just products, they’re integral to billions of people’s daily lives. Alphabet’s ecosystem, with over 2 billion users across seven services and 150 million Google One subscribers, creates a moat that’s tough to challenge.

The advertising business remains Alphabet’s cash cow, generating $66.89 billion in Q1 2025, up 8.5% year-over-year, despite economic uncertainties like tariff-related headwinds from APAC-based retailers. This growth signals confidence from businesses anticipating economic recovery, as ad spending often reflects optimism about future demand.

Don’t Ignore the AI Piece

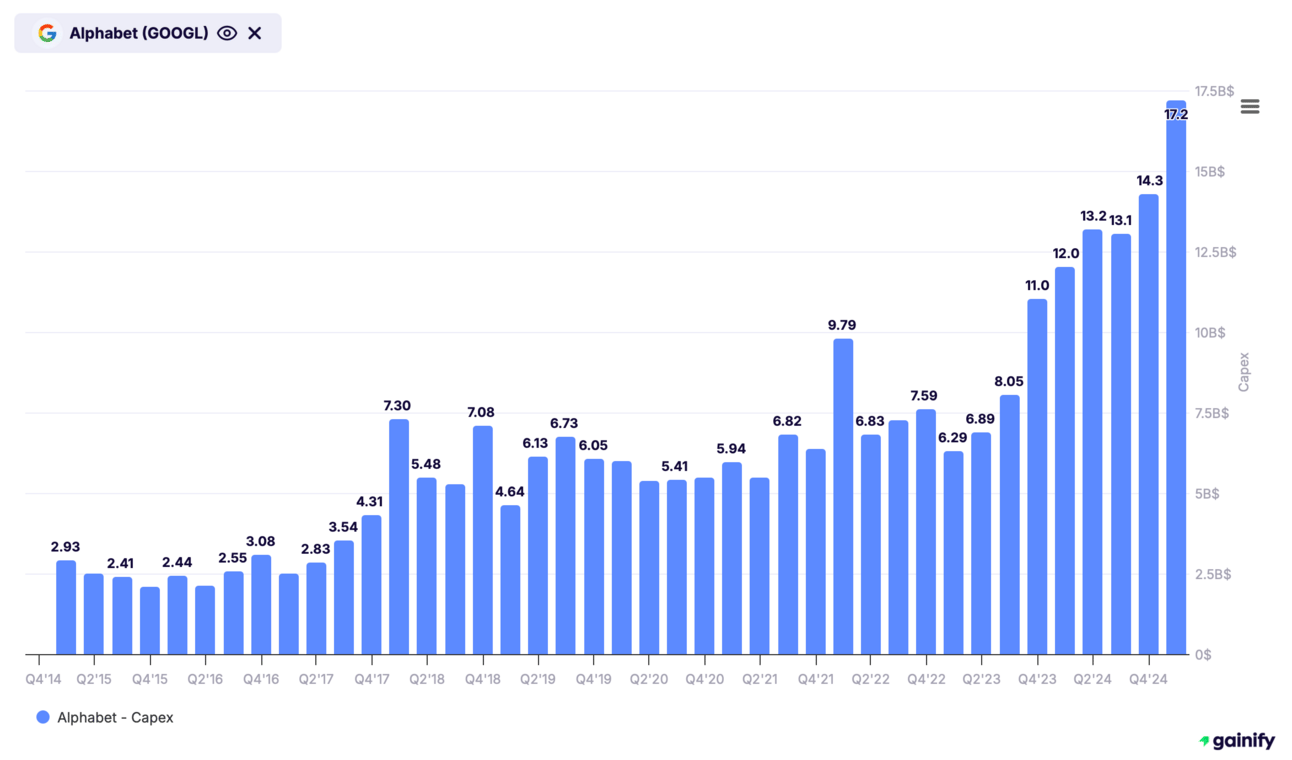

While Microsoft and OpenAI dominate AI headlines, Alphabet has been a pioneer in artificial intelligence for years. Their AI Overviews feature, now serving 1.5 billion monthly users across 200+ countries, enhances Google Search by providing AI-generated answers to complex queries. The Gemini models are gaining traction, with developer usage on Gemini doubling to 4.4 million in just six months. Alphabet’s $75 billion capital expenditure plan for 2025, largely focused on AI infrastructure like servers and data centers, underscores their commitment to staying at the forefront of AI innovation. This investment is already paying off, with Google Cloud revenue soaring 28% to $12.26 billion in Q1 2025, driven by demand for AI solutions.

The market may be sleeping on Alphabet’s AI progress, but with 7 million developers building on the Gemini API and a 40x increase in Gemini usage on Vertex AI since last year, I believe recognition is coming.

A Healthy Balance Sheet and Smart Capital Allocation

Alphabet’s financial strength is undeniable. As of Q1 2025, they held $95 billion in cash and marketable securities with zero long-term debt, providing unmatched flexibility. In April 2025, Alphabet raised its quarterly dividend by 5% to 21 cents per share and authorized a $70 billion stock buyback program, signaling confidence in future growth. These moves not only reward shareholders but also reduce outstanding shares, potentially boosting earnings per share, which hit $2.81 in Q1 2025, a 49% increase year-over-year.

Valuation Still Makes Sense

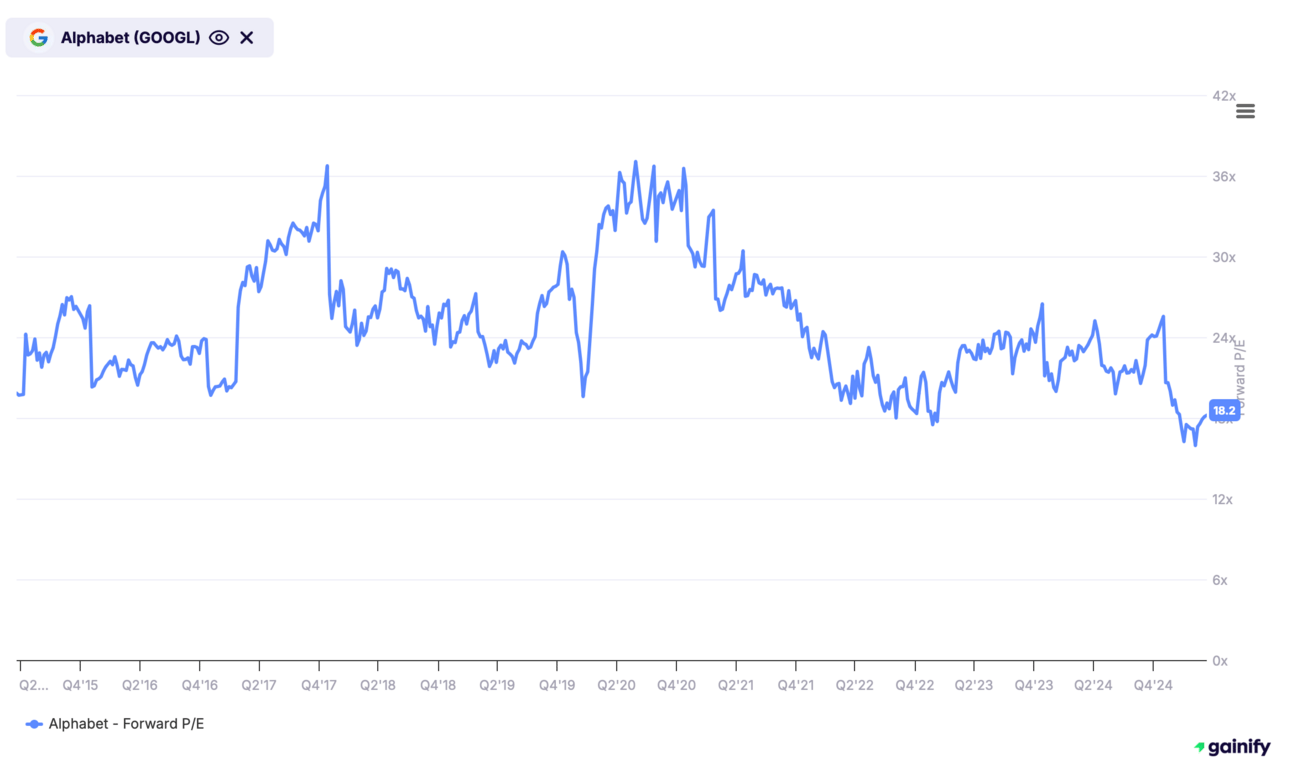

Despite its dominance, $GOOGL trades at a forward price-to-earnings (P/E) ratio of 17.33, lower than peers like Microsoft (26.56) and Meta (20.49). With a PEG ratio of 1.25 based on a 5-year expected earnings growth of 14.8%, Alphabet appears reasonably priced for its growth potential. Q1 2025 revenue reached $90.23 billion, up 12% year-over-year, beating analyst expectations of $89.12 billion. Analyst sentiment remains strong, with a consensus “Moderate Buy” rating and an average price target of $198.63, implying a 23% upside from current levels around $173.32 as of June 18, 2025.

Final Thoughts

Alphabet is a core holding for any long-term portfolio, it is stable, well-managed, diversified, and still growing. Its Q4 2024 revenue of $96.5 billion, a 12% increase, and Google Cloud’s 30% growth to $12.0 billion highlight its resilience across segments. It won’t double overnight, but it doesn’t need to. With unmatched brand power, AI leadership, and a rock-solid balance sheet, $GOOGL is a stock I’m comfortable holding for the next decade.

If you’re building a portfolio for the long haul, $GOOGL deserves a spot on your watchlist or maybe even in your portfolio.