Why VOO, QQQM, and SCHD Are the Best Index Funds for Your Portfolio

Investing in index funds has become a go-to strategy for many investors seeking long-term growth and diversification without the need to pick individual stocks. Among the plethora of options available, VOO, QQQM, and SCHD stand out as some of the best choices for building a robust and well-balanced portfolio. Here's why these three index funds should be at the core of your investment strategy.

1. VOO: The Vanguard S&P 500 ETF

VOO is a widely recognized and respected ETF that tracks the S&P 500 Index, comprising 500 of the largest U.S. companies. This index fund is a cornerstone for many portfolios, and for good reason.

Key Benefits:

- Broad Market Exposure: VOO provides investors with exposure to a diverse array of industries, from technology to healthcare to consumer goods. This broad market coverage ensures that you're investing in the overall U.S. economy.

- Low Expense Ratio: With an expense ratio of just 0.03%, VOO is one of the most cost-effective ways to gain exposure to the S&P 500. Lower costs mean more of your money stays invested and working for you over time.

- Strong Historical Performance: The S&P 500 has historically delivered strong long-term returns, and VOO has mirrored that performance, making it a reliable choice for growth-focused investors.

For those seeking to capture the overall market's performance with a long-term horizon, VOO is a top-tier option.

2. QQQM: The Invesco Nasdaq-100 ETF

QQQM offers exposure to the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange. This ETF is particularly attractive for investors who want to tap into the tech-driven growth of the modern economy.

Key Benefits:

- Technology-Centric: The Nasdaq-100 is heavily weighted towards technology companies, including giants like Apple, Microsoft, and Amazon. As technology continues to shape the future, QQQM allows investors to benefit from the sector's growth.

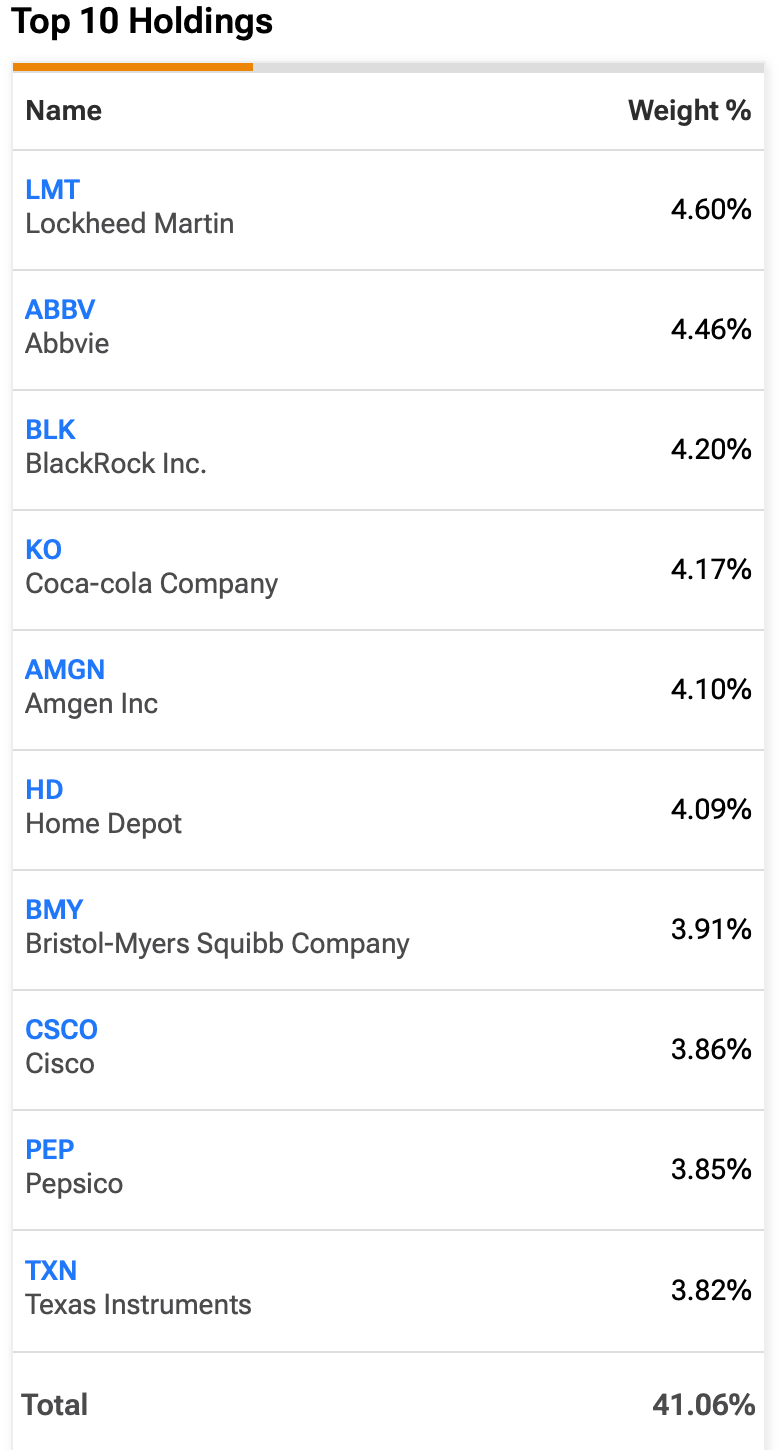

Top 10 Holdings

- Innovative Companies: Beyond technology, QQQM includes companies in sectors like consumer discretionary and healthcare that are at the forefront of innovation. This makes the ETF a play on the future of multiple industries.

- Cost-Effective: QQQM offers a slightly lower expense ratio compared to its larger counterpart, QQQ, making it an attractive option for cost-conscious investors who still want to capture the high growth potential of the Nasdaq-100.

For investors looking to capitalize on the growth of leading tech and innovation-driven companies, QQQM is an excellent choice.

3. SCHD: The Schwab U.S. Dividend Equity ETF

SCHD is a unique index fund focused on high-quality dividend-paying U.S. stocks. It tracks the Dow Jones U.S. Dividend 100 Index, which screens for companies with strong dividend yields and consistent dividend growth.

Key Benefits:

- Income Generation: SCHD is designed for income-focused investors, offering a dividend yield that is often higher than the broader market. This makes it an ideal choice for those looking to generate passive income.

- Dividend Growth: The ETF not only focuses on current yield but also on companies with a strong track record of growing their dividends. This provides the potential for increasing income over time, which can be particularly valuable in a retirement portfolio.

- Quality Companies: The fund's emphasis on companies with strong balance sheets and a history of paying dividends ensures that investors are exposed to high-quality, financially stable businesses.

For those who prioritize income and long-term stability, SCHD is a standout option.

Why These Three Funds Work Well Together

By combining VOO, QQQM, and SCHD, investors can achieve a well-rounded portfolio that captures the growth of the U.S. economy, the innovation of the technology sector, and the income potential of high-quality dividend stocks.

- Diversification: Each of these funds offers exposure to different segments of the market, reducing risk through diversification. VOO gives you broad market exposure, QQQM adds a focus on high-growth tech and innovative companies, and SCHD provides a steady income stream from dividends.

- Balance of Growth and Income: While VOO and QQQM are more growth-oriented, SCHD adds a layer of income stability, which can be especially important in volatile markets or for those nearing retirement.

- Cost Efficiency: All three funds are known for their low expense ratios, ensuring that investors can maximize their returns without being eroded by high fees.

Conclusion

VOO, QQQM, and SCHD represent the best of what index funds have to offer. Together, they provide a powerful combination of growth, income, and diversification, making them ideal for both new and experienced investors looking to build a resilient portfolio. Whether you're seeking long-term growth, exposure to cutting-edge industries, or reliable income, these ETFs offer a well-rounded approach to achieving your financial goals.

Disclosure: I currently hold positions in Vanguard S&P 500 ETF (VOO), Invesco NASDAQ 100 ETF (QQQM), and Schwab U.S. Dividend Equity ETF (SCHD). This article reflects my personal views and should not be taken as financial advice. Investments in the stock market carry risks, and it’s important to conduct your own research or consult with a financial professional before making any investment decisions.