The Most Underrated Stock: Cheesecake Factory's Recipe for Success

Earnings Analysis: The Cheesecake Factory Q2 2024

The Cheesecake Factory (NASDAQ: CAKE) reported strong financial results for the second quarter of fiscal 2024, demonstrating solid performance amidst a challenging economic environment. Total revenues for the quarter increased to $904.0 million, up from $866.2 million in the same period last year, marking a 4.4% year-over-year growth. Net income rose significantly to $52.4 million, or $1.08 per diluted share, compared to $42.7 million, or $0.87 per diluted share, in Q2 2023. Adjusted net income, which excludes certain one-time items, was $53.2 million, or $1.09 per diluted share.

Key highlights from the earnings report include a 1.4% increase in comparable restaurant sales at The Cheesecake Factory locations, reflecting strong consumer demand for the company's distinctive dining experience. The company also reported improved operational metrics, with notable year-over-year improvements in labor productivity and staff retention. The robust earnings growth was further supported by better-than-expected profit margins.

The company continues to expand its footprint, opening five new restaurants across various concepts in Q2, including one Cheesecake Factory, one North Italia, two Flower Child locations, and one Culinary Dropout. This expansion aligns with the company's goal to open up to 22 new restaurants in 2024, indicating confidence in its growth strategy and market demand for its offerings.

From a liquidity perspective, The Cheesecake Factory maintains a strong position with $277.2 million in total available liquidity, comprising $40.7 million in cash and $236.5 million available on its revolving credit facility. The company's debt load stands at $475.0 million, with a substantial portion tied to convertible senior notes due in 2026. Additionally, the company repurchased approximately 111,400 shares at a cost of $3.9 million, demonstrating a commitment to returning value to shareholders.

Many of you may not know, but CAKE is more than just the Cheesecake Factory:

Why The Cheesecake Factory (CAKE) is an Underrated Stock

Steady Revenue Growth: Despite a competitive market, The Cheesecake Factory has shown consistent revenue growth, with Q2 2024 revenues up 4.4% year-over-year. This growth, coupled with the company's resilience in maintaining stable top-line revenue, suggests strong underlying business fundamentals.

Operational Efficiency: The company's focus on improving labor productivity and retention has contributed to better-than-expected profit margins, showcasing effective management and cost control measures. This operational efficiency is crucial for sustaining profitability, especially in a high-cost environment.

Expansion and Diversification: The company's diverse portfolio, including brands like North Italia and Flower Child, broadens its market reach and reduces reliance on a single brand. The expansion into international markets, particularly with The Cheesecake Factory brand, offers additional growth opportunities.

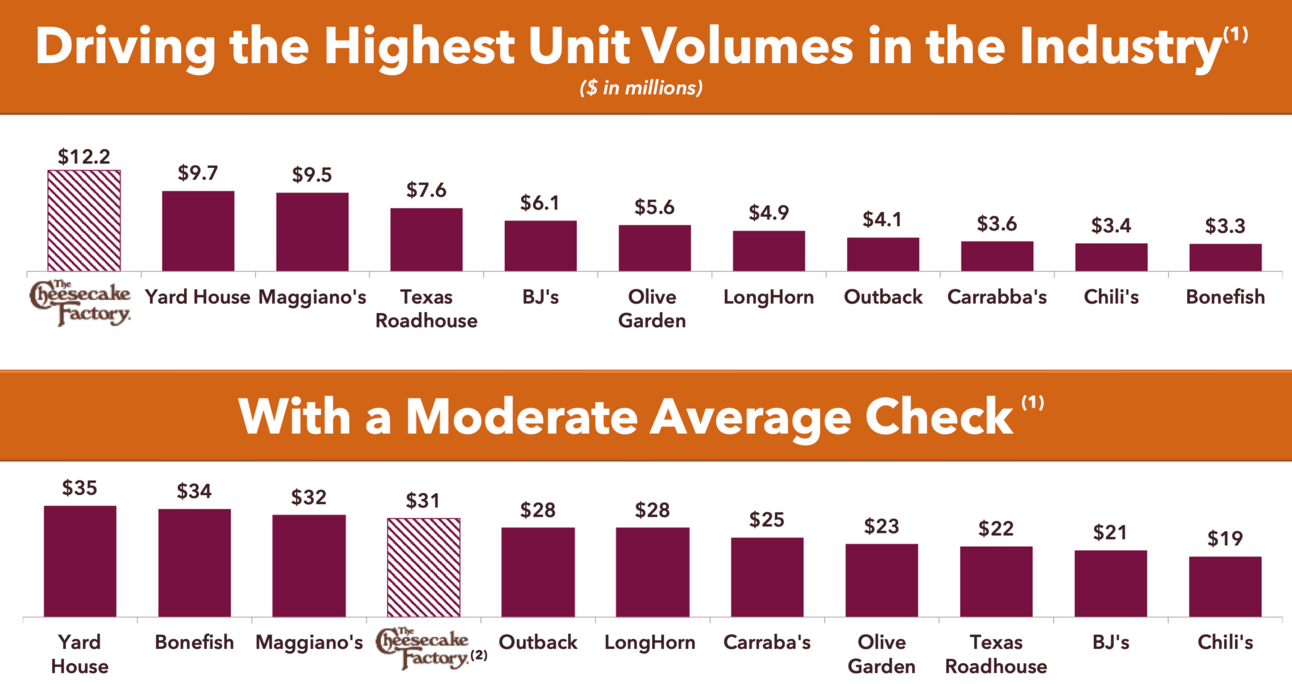

Attractive Valuation: Despite its strong performance, CAKE remains undervalued compared to peers in the casual dining sector. The stock's current valuation does not fully reflect its growth potential and operational strengths, presenting a compelling buying opportunity for investors seeking value in the restaurant industry. It currently only has a Forward P/E of 12!

Shareholder Returns: The company's ongoing share repurchase program and dividend payments underscore its commitment to delivering value to shareholders. The recent quarterly dividend of $0.27 per share reflects a solid yield, making CAKE an attractive choice for income-focused investors.

Conclusion

In summary, The Cheesecake Factory's solid financial performance, operational improvements, strategic expansion, and attractive valuation make it an underrated stock with potential for significant upside. As the company continues to execute its growth strategy and capitalize on market demand, CAKE presents a compelling investment opportunity for long-term investors.

Disclaimer

I have a personal stake in The Cheesecake Factory Incorporated (NASDAQ: CAKE) stock. This disclosure is important to clarify that my perspective on CAKE does not constitute financial advice. Instead, it aims to offer a balanced viewpoint along with relevant insights about the company. Personally, I view The Cheesecake Factory as a promising long-term investment opportunity with potential for growth. However, it is crucial to conduct thorough research and consider your own financial circumstances before making any investment decisions.