When the market is soaring, it’s easy to become fully invested, chasing the next big stock or sector that’s performing well. It can be tempting to allocate every dollar to an opportunity that seems too good to pass up. But seasoned investors know the value of patience—and more importantly, the power of cash reserves, especially in a volatile market. In times of uncertainty, cash isn’t just king; it’s your shield and your sword.

Why Cash Reserves Are Essential

Cash reserves are like a safety net in investing, providing flexibility and security when the market takes an unexpected turn. We’ve all seen how unpredictable the market can be—one day, stocks are hitting all-time highs, and the next, they’re tumbling over fears of inflation, interest rates, or geopolitical events. In these moments, having a portion of your portfolio in cash allows you to act decisively rather than panic or sell investments at a loss.

The key benefit of having cash ready is that it provides you with optionality. Instead of being forced into making poor decisions—like selling off a strong long-term investment at the wrong time—you have the liquidity to capitalize on market dips and buy undervalued stocks. Cash gives you the opportunity to turn market volatility into an advantage.

Personally, this is one of the reasons I raised cash by selling my entire $META position earlier this year. After holding $META for over two years and realizing significant gains, I saw other opportunities on the horizon that I wanted to be prepared for. Selling when the stock was up allowed me to have the liquidity to take advantage of dips in companies I have high conviction in, like $SOFI, $AMZN, and $PLTR.

The Problem with Being Fully Invested

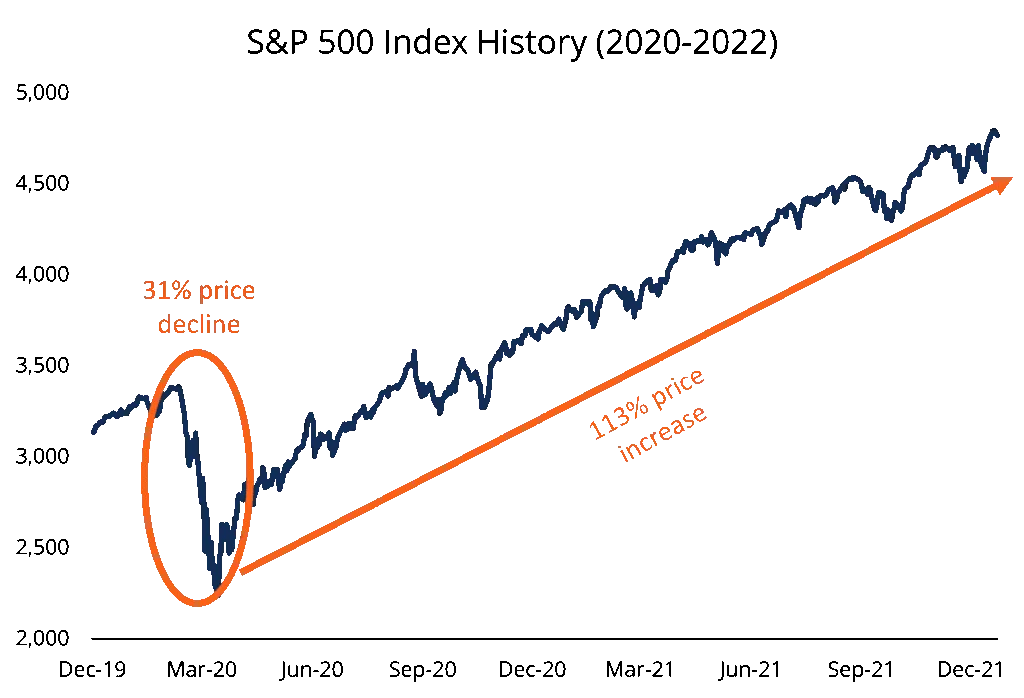

Many investors think they need to be fully invested at all times to maximize returns. While being fully invested can work in a strong bull market, it leaves little room to maneuver when things take a downturn. Markets don’t move in a straight line, and corrections or even bear markets are inevitable. In these periods, fully invested portfolios are at the mercy of market swings.

For example, imagine being fully invested in growth stocks when the market corrects by 10%, 20%, or even 30%. You’re left with few options but to ride it out or sell at a loss. However, if you had set aside cash, you’d have the ability to buy those same stocks at a discount, allowing you to strengthen your position at a lower cost basis. It’s this flexibility that can lead to significantly greater long-term returns.

I learned this lesson firsthand when the markets took a sharp dip in 2022. Holding onto some cash during that volatile time allowed me to buy stocks that I believed in at much lower prices. While others panicked and sold, I was able to build my positions in companies like $SOFI and $HIMS, taking advantage of the opportunities that volatility presented.

Timing the Market vs. Being Prepared

Many people avoid holding cash because they fear missing out on market gains, or they’re waiting to time the market perfectly. But here’s the truth: no one can time the market consistently. Even the best investors can’t predict when the next correction or downturn will happen. That’s why it’s not about timing the market—it’s about being prepared when the market presents opportunities.

I don’t keep cash in my portfolio to time every dip perfectly. Instead, I see it as a buffer that gives me the freedom to act when great companies go on sale. For example, when $META reached an all-time high earlier this year, I felt the stock had appreciated enough for me to take profits and redeploy that cash elsewhere. That decision allowed me to raise cash for future buying opportunities, which I’ve since used to increase my positions in $HIMS and $PLTR, both of which I believe have tremendous long-term growth potential.

Having cash ready allowed me to stay patient and disciplined, rather than reacting to every market fluctuation. It’s a strategy that not only helps reduce risk but also allows you to take advantage of volatility when others may be acting irrationally out of fear.

How Much Cash Should You Keep on Hand?

So, how much cash should you hold in your portfolio? There’s no one-size-fits-all answer here, as it depends on your individual goals, investment strategy, and risk tolerance. For long-term investors, cash reserves typically range from 5-10% of the total portfolio. However, if you’re more conservative or expect increased volatility, you may want to hold a larger cash position, around 15-20%.

It’s important to remember that cash in your portfolio doesn’t have to sit idly in a savings account. There are plenty of low-risk options for parking cash that can still earn you a return while keeping it easily accessible. High-yield savings accounts, money market funds, or short-term bond ETFs are great options that provide liquidity while earning better returns than a traditional bank account.

Personally, I keep cash reserves in a high-yield savings account. This allows my money to grow, albeit modestly, while staying liquid enough to act when a buying opportunity presents itself. The key is to ensure that your cash is readily available when you need it, without being subject to unnecessary risk or locking it away for too long.

Via Yahoo Finance

The Power of Buying the Dip

One of the most effective ways to grow wealth as an investor is by buying high-quality companies at discounted prices during market corrections. The phrase “buy the dip” is often thrown around casually, but it’s a strategy that requires preparation and discipline. Having cash reserves allows you to take advantage of those dips in a way that fully invested portfolios simply can’t.

When stock prices fall due to broader market fears—not because of a company’s fundamentals—you’re presented with a golden opportunity. A company like $HIMS, for example, may see its stock price drop 10-15% in a market downturn, even though the business itself continues to perform well. With cash on hand, you can buy shares at a discount and position yourself for long-term gains when the market recovers.

This strategy is one of the reasons I was able to significantly increase my positions in $SOFI and $PLTR during periods of market weakness. By having cash reserves ready, I wasn’t scrambling to free up capital or selling other stocks at a loss. Instead, I could confidently buy into companies I believe in for the long haul, taking advantage of the lower prices without sacrificing other investments.

Here is my post on X, about why I sold Meta:

Conclusion: Cash as a Strategic Asset

In the world of investing, cash is often underrated. But in a volatile market, it’s one of the most powerful tools you can have. Cash provides you with optionality, flexibility, and the ability to turn market downturns into opportunities for growth. It’s not about trying to time the market perfectly; it’s about being prepared when the market presents you with opportunities.

For me, keeping cash reserves has been a game-changer in how I manage my portfolio. By selling my $META position and raising cash, I’ve been able to buy into companies I believe in, like $HIMS and $PLTR, when the time is right. It’s a strategy that has allowed me to stay patient, disciplined, and opportunistic in the face of volatility.