With so many investment options out there, choosing between individual stock-picking and index fund investing can feel overwhelming. My girlfriend recently started her Roth IRA, opting to invest in $VTI, a total market index fund. Meanwhile, I’ve built a portfolio by picking individual stocks that I believe have strong growth potential. Both strategies have their advantages and risks, so how do you decide which is right for you?

Let’s break down the key factors to consider.

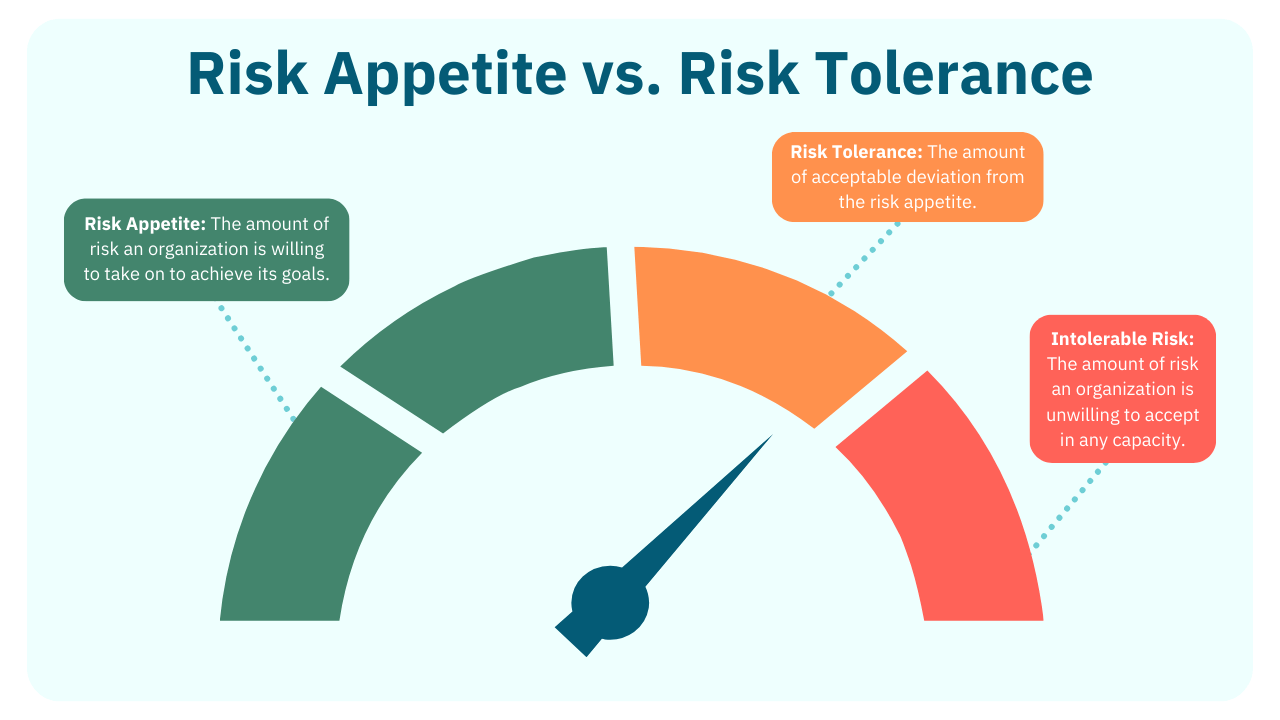

1. Risk Tolerance

One of the biggest differences between stock-picking and index fund investing is the level of risk involved. When you pick individual stocks, you're betting on a specific company to perform well. This can lead to massive gains but also leaves you exposed to greater losses if that company underperforms. For example, I’ve seen major returns with $AMZN, $PLTR, and $UBER, but there’s always the risk of a dip in one of those sectors.

On the other hand, index funds like $VTI spread your investment across hundreds or even thousands of companies. This diversification reduces risk because your money is spread across the broader market. Even if one sector underperforms, others may pick up the slack, making it less likely that you’ll see extreme swings in your portfolio.

Which is right for you?

If you’re comfortable with higher risk for potentially higher returns, stock-picking could be your path. But if you prefer more stability and less volatility, index funds might be the better choice.

2. Time Commitment

Stock-picking requires time and research. You need to stay on top of earnings reports, industry trends, and company news to ensure you’re making informed decisions. I spend a lot of time analyzing companies like $HIMS and $NKE to evaluate their future potential and growth prospects. For some, this can be exciting and rewarding, but it’s certainly not passive.

Investing in index funds, however, is a more hands-off approach. Since index funds are designed to track the broader market, you don’t need to constantly monitor or rebalance your investments. Once you’ve made your investment, you can essentially “set it and forget it.” For my girlfriend, who doesn’t have the same interest in daily market movements, this passive approach through $VTI is perfect.

Which is right for you?

If you enjoy staying engaged with the market and researching individual stocks, you might lean toward stock-picking. But if you’re looking for a low-maintenance, long-term investment strategy, index funds are a solid option.

3. Potential Returns

It’s true that picking the right stocks can lead to outsized gains. Take my $META investment, for instance, which paid off big after holding it for two years. But not every stock will perform that way, and the possibility of choosing a poor performer always exists.

Index funds, while typically more stable, may not offer the same level of explosive growth. Since they track the entire market, you’re more likely to see returns that mirror overall market performance. Historically, the U.S. stock market has returned around 7-10% per year over the long term. While that’s a respectable return, it may not match the potential gains of a carefully chosen individual stock that doubles or triples in value.

Which is right for you?

If you’re aiming for maximum returns and are willing to take the risk, stock-picking might appeal to you. However, if you’re content with steady, reliable growth over time, index funds could offer a more predictable path.

4. Diversification

Diversification is key to managing risk. When you buy an index fund like $VTI, you’re automatically invested in a broad array of companies, from small-cap to large-cap, across various industries. This provides instant diversification without the need to buy individual stocks.

Stock-picking, by contrast, often results in a less diversified portfolio unless you own a large number of stocks across different sectors. In my portfolio, for instance, I’m heavily focused on a few sectors like tech and consumer cyclical, but I actively manage it to maintain balance. This requires constant re-evaluation to ensure I’m not too exposed to one sector’s performance.

Which is right for you?

If you want instant diversification without the effort, index funds are a simple way to achieve that. If you prefer to tailor your portfolio and have more control over your investment choices, stock-picking might be your preferred strategy.

5. Costs and Fees

Another important factor is cost. Most index funds, especially those like $VTI, have very low expense ratios (typically around 0.03% or lower). These low fees allow more of your money to stay invested and grow over time. Additionally, buying into index funds often requires fewer transactions, which means lower brokerage fees overall.

Stock-picking, however, can sometimes result in higher costs, especially if you’re making frequent trades or investing in smaller companies with larger bid-ask spreads. Even though I use SoFi, which has commission-free trading, those who frequently buy and sell stocks should consider potential costs associated with active trading.

Which is right for you?

If minimizing fees is a priority, index funds are generally more cost-effective. But if you’re willing to absorb higher costs in exchange for the chance at higher returns, stock-picking might still make sense.

Conclusion: Which Strategy is Better?

There’s no one-size-fits-all answer here. The best strategy depends on your individual goals, risk tolerance, and the amount of time you’re willing to dedicate to managing your investments.

For beginners or those who prefer a hands-off approach, index funds like $VTI offer a simple, low-cost way to grow wealth over time with less risk.

For those more experienced or willing to take on more risk, stock-picking can offer higher potential rewards but requires more effort, research, and a higher tolerance for volatility.

Personally, I take a hybrid approach. In my Roth IRA, I invest exclusively in index funds like $VTI. I see my Roth as a long-term retirement vehicle where stability and tax-efficient growth are key, so I prefer the broad market exposure and low fees that index funds provide. This hands-off approach works well for a tax-advantaged account designed to grow over decades.

On the other hand, in my taxable brokerage account, I focus solely on individual stocks. Here, I can actively manage my portfolio, picking companies like $AMZN, $PLTR, and $HIMS that I believe have strong growth potential. This allows me to take advantage of opportunities and capitalize on individual stock performance, while keeping my long-term, tax-efficient investments separate in my Roth.