Introduction

Investment strategies can significantly impact long-term financial success, especially in volatile markets. Dollar-Cost Averaging (DCA) is a well-regarded approach known for reducing the risk associated with market timing. Recently, variants of this strategy, Simplified and Modified DCA, have evolved to cater to the varying needs of today’s diverse investor base. This article examines these strategies in detail, exploring how they work and who might benefit from each.

Simplified Dollar-Cost Averaging (DCA)

Core Concept

Simplified DCA distills traditional DCA principles into a user-friendly format that requires minimal active management. This strategy is particularly appealing to novice investors or those who prefer a hands-off investment approach.

Mechanics of Simplified DCA

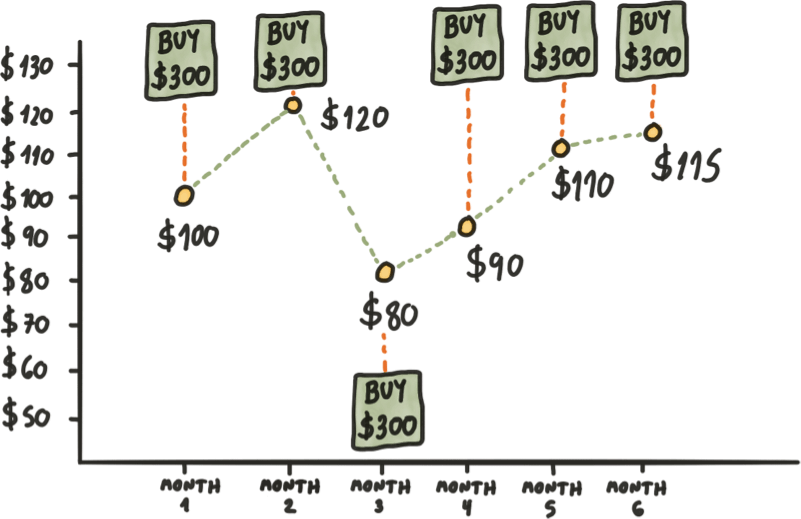

Regular Investments: This strategy involves consistent investments of fixed amounts at regular intervals (e.g., monthly or quarterly), regardless of the asset's price.

Asset Selection: Simplified DCA typically uses a predetermined, diversified set of assets to reduce decision complexity and maintain a balanced portfolio.

Automation: Utilizing technology, investments are automated through platforms that schedule and execute buys, making the process seamless and disciplined.

Strategic Benefits

Minimized Emotional Investing: Reduces the psychological stress of trying to time the market.

Cost Averaging: Over time, regular investments can average out the cost of asset purchases, potentially reducing the impact of volatility.

Builds Investing Discipline: Encourages steady investment habits that can lead to substantial growth through compounding over the long term.

Modified Dollar-Cost Averaging (DCA)

Advanced Approach

Modified DCA introduces a more dynamic strategy that adjusts contributions in response to market conditions, aiming to optimize the investment return potential more actively.

How It Works

Initial Capital Injection: Begins with a substantial initial investment (lump sum) that seeks to immediately leverage potential market undervaluation.

Adaptive Investment Scale: Contribution amounts are adjusted based on real-time market analysis, investing more during market lows and less during highs.

Utilization of Market Indicators: Employs sophisticated indicators like P/E ratios, MACD, or RSI to guide investment decisions, enhancing the strategy's responsiveness to market dynamics.

Benefits

Market Responsiveness: Allows for tactical adjustments that can capitalize on market trends and corrections.

Enhanced Potential Returns: By strategically increasing investments during downturns, it exploits lower prices for potentially higher returns upon market recovery.

Customizable Risk Management: Adapts to both market conditions and individual risk tolerance, offering a tailored investment approach.

Comparative Insights

Key Differences and Investor Suitability

Feature | Simplified DCA | Modified DCA |

|---|---|---|

Investment Frequency | Fixed intervals | Flexible, market-dependent intervals |

Investment Amounts | Fixed | Variable, based on strategic decisions |

Market Adaptability | Low | High |

Complexity | Low | High |

Recommended for | Novices, passive investors | Experienced, active investors |

Conclusion

Choosing between Simplified and Modified Dollar-Cost Averaging depends largely on an investor's market experience, time availability for managing investments, and risk tolerance. Simplified DCA is ideal for those who wish to invest without the anxiety of market fluctuations, whereas Modified DCA suits those who are more engaged and seek to maximize their returns through more active involvement in their investment decisions.

Both strategies uphold the foundational benefits of DCA—mitigating timing risks and facilitating gradual market entry—but they do so in ways that align with different investor profiles and goals. Understanding these nuances can empower investors to select the approach that best complements their financial goals and investment philosophy.