Maximizing Investment Success: Understanding the Critical Role of Earnings Calls and Financial Statements for Stock Pickers

Introduction

Successful investing in individual stocks demands a profound understanding of a company's financial health and strategic direction. Earnings calls and financial statements are indispensable tools in this analysis, providing deep insights that can significantly influence investment decisions. This article delves into the essential roles these resources play and why they are critical for every stock picker.

The Vital Role of Earnings Calls

Understanding Earnings Calls

Earnings calls are public conference calls conducted by publicly traded companies each quarter. These calls are led by top executives, such as the CEO and CFO, who discuss financial results and provide insights into the company's operations and strategies. They also address questions from analysts and investors, offering a rare direct line to the company's leadership.

Benefits of Attending Earnings Calls

Direct Access to Management: These calls offer a firsthand look at the company’s leadership, allowing investors to assess the management's confidence and capabilities.

Qualitative Insights: Beyond the numbers, executives discuss future strategies, market conditions, and operational hurdles, offering a narrative that complements quantitative data.

Real-Time Information: Earnings calls provide timely updates, essential for making informed decisions quickly.

Understanding Investor Sentiment: Questions and comments during the call can provide insights into the broader market’s view and expectations from the company.

The Importance of Financial Statements

What Are Financial Statements?

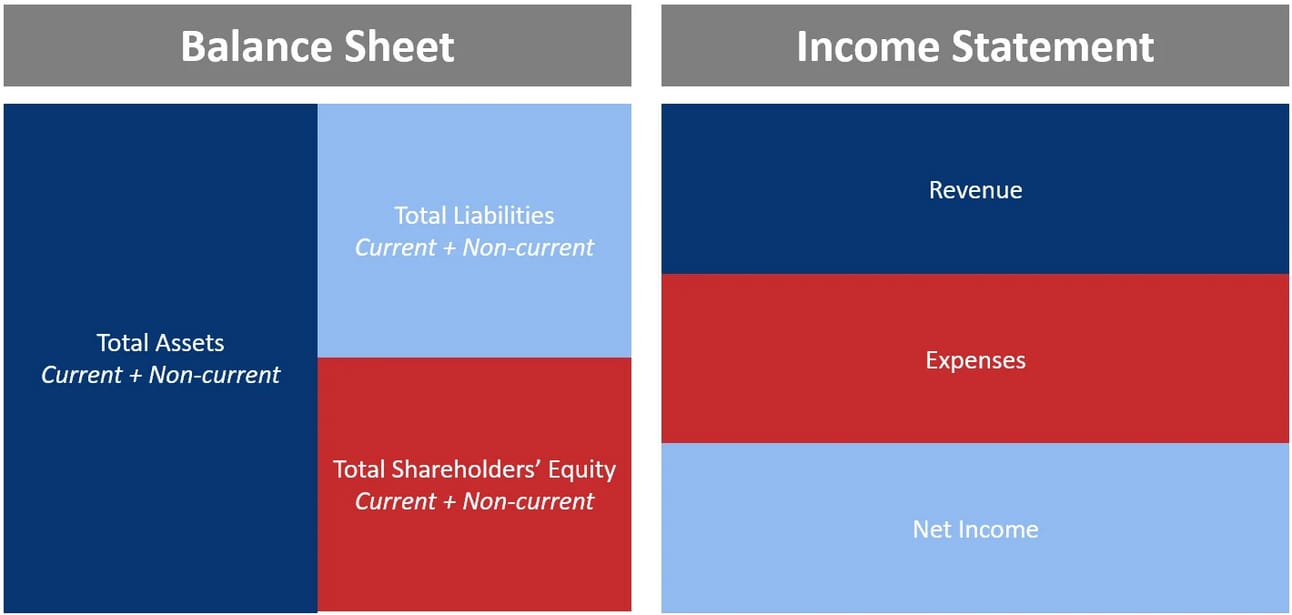

Financial statements are formal records of the financial activities and status of a business. The primary statements include the balance sheet, income statement, and cash flow statement, each offering different insights into the financial health of a company.

Why Analyze Financial Statements?

Comprehensive Financial Overview: These documents show a company’s assets, liabilities, revenues, and expenses, providing a snapshot of its financial robustness.

Performance Metrics: Investors can extract critical metrics such as earnings per share (EPS), return on equity (ROE), and the debt-to-equity ratio, which are pivotal for comparing companies within the same industry.

Historical Performance: They allow investors to track performance over time, aiding in trend identification and future performance projections.

Risk Assessment: Detailed analysis can reveal risks such as high debt levels or cash flow problems, which might not be apparent from earnings calls alone.

Integrating Earnings Calls and Financial Statements

Comprehensive Analysis Approach

To make informed investment decisions, savvy investors integrate insights from both earnings calls and financial statements. While the financial statements offer the hard numbers, earnings calls provide context and strategic insight, painting a complete picture of a company's potential.

Practical Example

Imagine a company reports a sudden increase in revenue. While the financial statements show the numbers, the earnings call might reveal that this increase is due to a one-time gain rather than sustainable growth. Conversely, a dip in earnings highlighted in the financial statements might be explained during the earnings call as a strategic investment that positions the company for future growth.

Here’s an example of an earnings call summary I provided on Ulta Beauty:

Conclusion

For individual stock pickers, the practice of analyzing both earnings calls and financial statements is invaluable. These tools offer a well-rounded view of a company's financial health and strategic prospects, enhancing the investor's ability to make informed decisions. Integrating these practices into your investment routine can significantly improve your outcomes and reduce investment risks. While they require a disciplined and diligent approach, the insights gained are well worth the effort, sharpening your acumen and potentially leading to greater success in the stock market.