- Ashton Invests

- Posts

- In-Depth Analysis of SoFi Technologies Stock

In-Depth Analysis of SoFi Technologies Stock

Sofi Stock Analysis

In-Depth Analysis of SoFi Technologies Stock

Overview of SoFi Technologies

SoFi Technologies, Inc. (NASDAQ: SOFI) is a financial technology company based in San Francisco, California. Founded in 2011, SoFi initially focused on student loan refinancing but has since expanded its services to include personal loans, mortgages, credit card offerings, investment and wealth management services, and insurance. The company went public through a SPAC merger with Social Capital Hedosophia Holdings Corp. V in June 2021.

CEO

Anthony Noto serves as the CEO of SoFi. With a background including senior roles at Twitter and Goldman Sachs, he brings extensive expertise in technology and finance to his current role. Noto's leadership at SoFi focuses on expanding product offerings and enhancing technology to improve financial services for consumers. He is known for driving innovation and strategic growth in the fintech industry, aiming to empower individuals through technology-driven financial solutions.

Business Model and Revenue Streams

1. Lending: SoFi’s primary revenue source, including student loan refinancing, personal loans, and home loans. The company leverages its technology to offer competitive interest rates and streamlined loan processing.

2. Financial Services (One-stop shop): SoFi's offerings include SoFi Invest, providing investment opportunities in stocks and ETFs; SoFi Money, a digital banking service; a credit card; and SoFi Relay, a financial management tool that includes credit scores. These services aim to create an integrated ecosystem for SoFi users, fostering cross-sell opportunities.

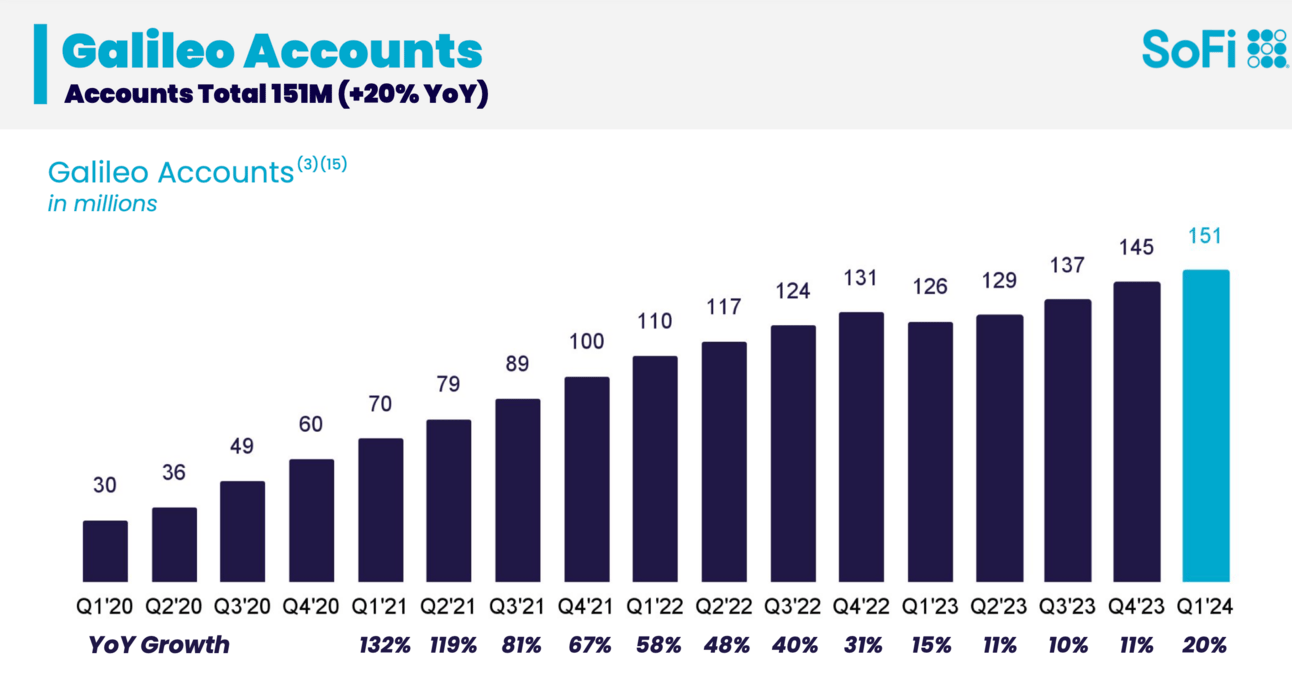

3. Technology Platform (Galileo): Acquired in April 2020, Galileo provides infrastructure for digital banking services, supporting other fintech companies and generating B2B revenue for SoFi. Despite its crucial role, this part of the company is often overlooked or underestimated in its impact on SoFi's overall strategy and growth in the fintech sector.

Credit to @KyleWhiteGOAT on X

Recent Financial Performance

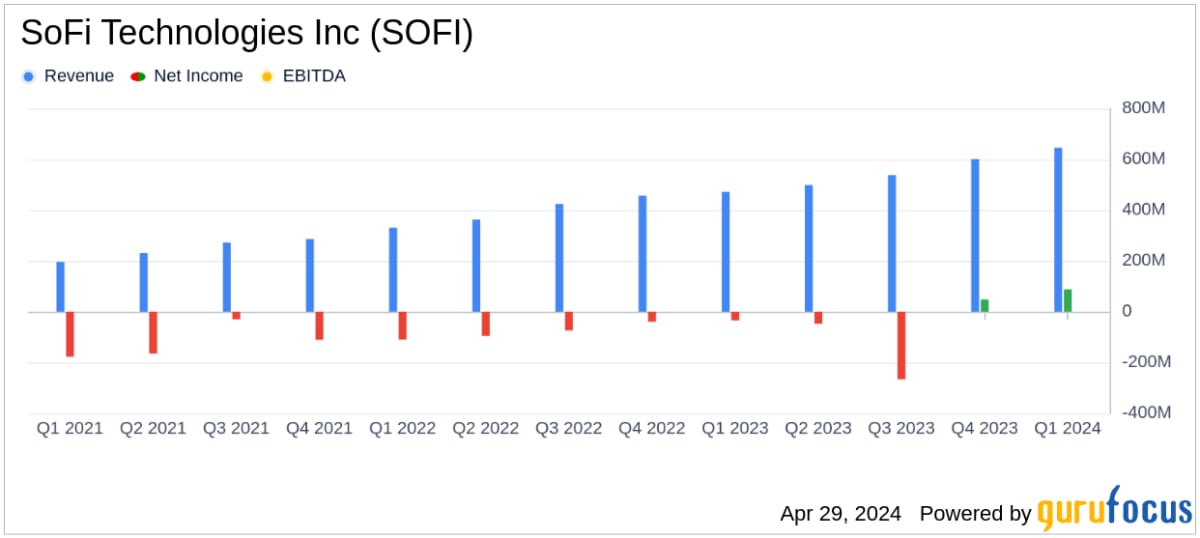

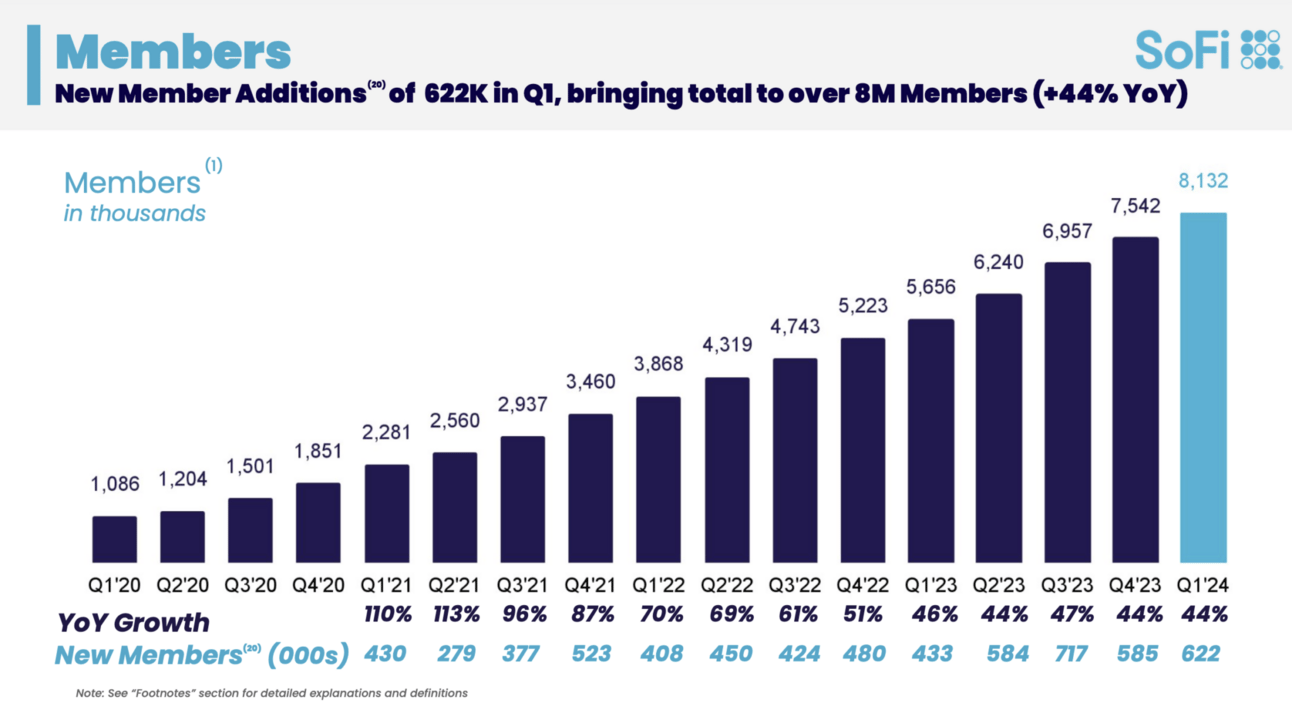

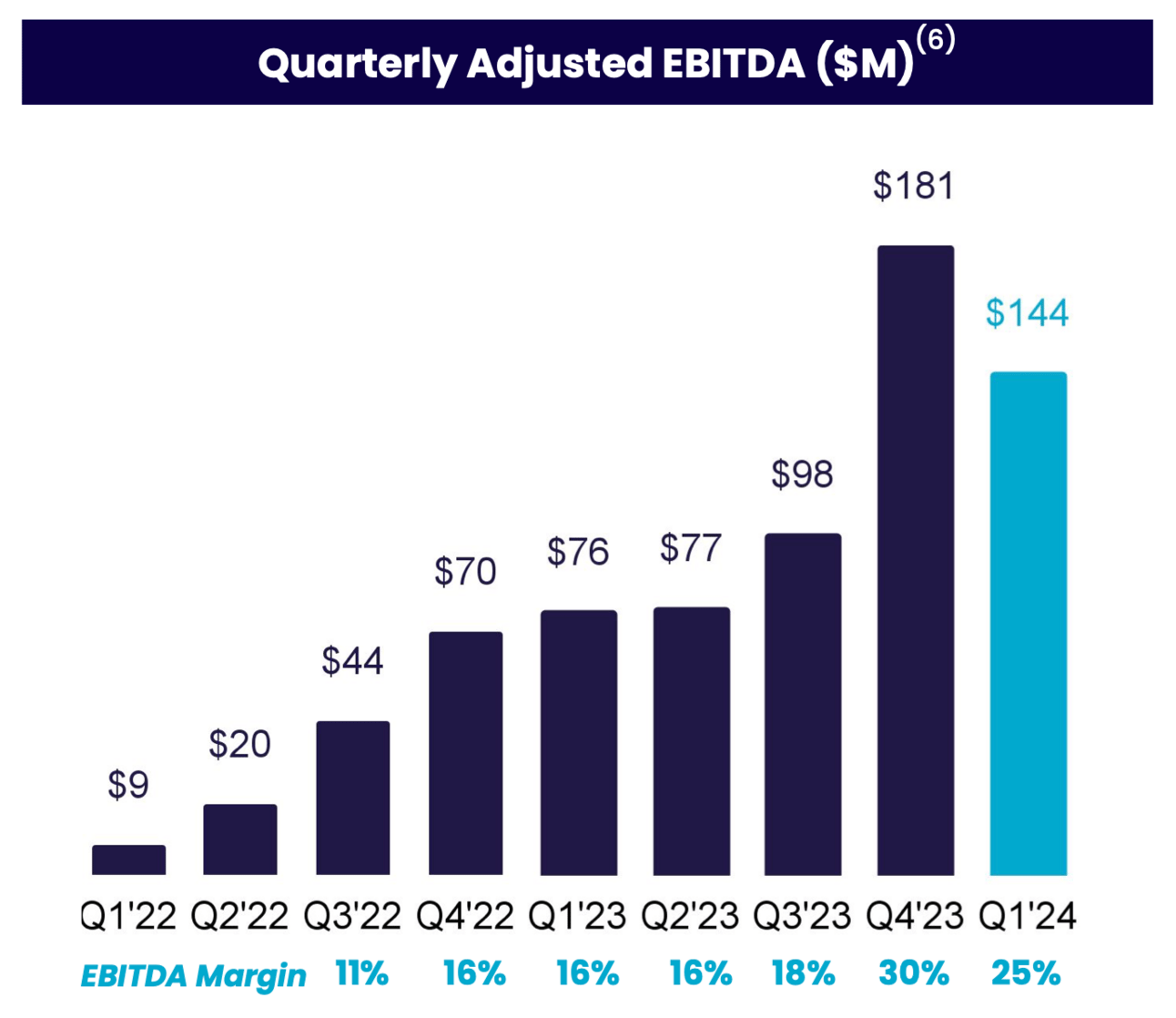

SoFi has demonstrated robust growth, with significant increases in both member base and revenue. Key metrics from the latest quarterly reports include:

- Revenue Growth: The company reported a GAAP net revenue of 645 million in Q1 2024, a 37% year-over-year increase.

Profitability…

- Membership Growth: SoFi added 622,000 new members in Q1 2024, bringing the total to over 8.1 million.

- Adjusted EBITDA: Achieved adjusted EBITDA of $144 million, highlighting operational improvements and scalability.

Competitive Landscape

SoFi operates in a competitive fintech space, facing rivals from traditional financial institutions and other fintech companies. Despite this competition, SoFi's rapid growth and diverse offerings set it apart in the industry. Key competitors include:

- Traditional Banks: Such as JPMorgan Chase, Bank of America, and Wells Fargo, which offer similar financial products.

- Fintech Companies: Including LendingClub, Affirm, Robinhood, and Chime. Each competitor has its strengths, with LendingClub focusing on peer-to-peer lending, Affirm on buy-now-pay-later services, Robinhood on commission-free trading, and Chime on digital banking.

Market Opportunities and Risks

Opportunities:

Expansion of Product Offerings: SoFi continues to innovate and diversify its financial products to appeal to a broader customer base. Professional research capabilities are potentially forthcoming on the investment platform, with tax services also being considered for future offerings.

Technological Advancements: Leveraging AI and machine learning to enhance customer experiences and operational efficiencies.

Strategic Acquisitions: Similar to the Galileo acquisition, further acquisitions could enhance SoFi’s technology stack and service offerings.

Regulatory Changes: Favorable regulatory changes, such as easing lending restrictions or new fintech-friendly regulations, could provide growth tailwinds. Additionally, if interest rates fall, that will also be beneficial.

A Completely Online Platform: They are strategically positioned to thrive and lead in the financial industry for future generations, ensuring sustained growth and innovation. This is also helps lower operating costs because there are no physical locations.

Risks:

Regulatory Environment: Stricter regulations in the financial services industry could increase compliance costs.

Economic Conditions: Economic downturns could lead to higher default rates on loans, affecting SoFi’s lending business.

Competition: Intensified competition from both fintech firms and traditional banks could impact market share and profitability.

Market Sentiment: As a publicly traded company, SoFi’s stock price is subject to market sentiment, which can be volatile, especially for growth-oriented tech stocks. As of recently the sentiment on Sofi has been very poor.

Stock Performance and Valuation

SoFi’s stock has experienced significant volatility since its public debut, reflecting broader market trends and sector-specific developments. As of the latest trading session, SoFi’s stock is trading at $6.77 per share, with a market capitalization of approximately $7.16 billion.

Valuation Metrics:

- Price-to-Earnings (P/E) Ratio: As a growth company still focusing on achieving sustained profitability, traditional P/E metrics may not fully capture the stock's potential. As of right now the Forward P/E is sitting at 74.6.

- Price-to-Sales (P/S) Ratio: SoFi’s P/S ratio stands at around 2.8, reflecting market expectations of future revenue growth.

- Enterprise Value/EBITDA (EV/EBITDA): This ratio is a valuable tool for comparing SoFi to other fintech companies. However, it's important to adjust this ratio to account for SoFi's growth stage and profitability trajectory. According to multiple analysts, SoFi's EV/EBITDA is projected to be approximately 8x in 2024, 4.8x in 2025, and 2.7x in 2026. The sector average sits around 10x.

For those of you who don’t know: A lower EV/EBITDA ratio indicates that a company may be more attractive as a potential investment. This suggests that the company's enterprise value (EV) is relatively low compared to its EBITDA, implying that the market might be undervaluing the company.

Analyst Recommendations

Wall Street analysts have mixed views on SoFi, with a consensus leaning towards a "HOLD" rating, citing the company’s strong growth prospects and innovative product offerings. The average price target is around $8.31, implying upside potential from current levels.

I have a "STRONG BUY" rating on this stock, with a price target of $10 for the next 12 months. If interest rates fall and the economy improves, this target is easily attainable.

I am extremely bullish for the upcoming earnings report, scheduled on July 30th before the market open.

Additional News

In a recent interview on CNBC on July 10th, Anthony Noto highlighted how SoFi has achieved significant growth without heavily relying on student loans, emphasizing the company's strong positioning and plans to refocus on loans. Noto expressed strong confidence in SoFi's potential as interest rates decrease. He also discussed leveraging AI to enhance financial assistance and answer customers' financial questions, indicating a forward-thinking approach to customer support and innovation. Sofi is not just a bank!

Additionally, Noto noted that a Republican administration would be better for the business and stated that he knows who he is voting for on election day.

Conclusion

SoFi Technologies is a promising fintech company with a diversified product portfolio and a strong growth trajectory. While the stock presents attractive long-term potential, it is essential to consider associated risks, including economic conditions and competitive pressures. For long-term investors like yourself, SoFi’s focus on technological innovation and expansion of its financial services ecosystem makes it a compelling investment. The risk-reward profile is excellent, offering significant upside potential despite the inherent volatility typical of high-growth companies.

Disclaimer

I have a personal stake in SOFI stock. It's important to clarify that this viewpoint does not constitute financial advice, but rather aims to provide a balanced perspective alongside relevant insights about the company. Personally, I believe SOFI represents a compelling long-term investment opportunity with significant upside potential. However, I strongly encourage conducting your own thorough research before making any investment decisions.

Reply