How to Hedge a Long-Term Investment Portfolio: Protecting Your Wealth While Maximizing Growth

Long-term investing is one of the most effective ways to build wealth. By holding onto a portfolio of stocks, bonds, and other assets over time, you can ride out market volatility and benefit from the power of compounding. However, even long-term investors are not immune to risk. Markets can swing sharply, and downturns can erode years of gains. This is where hedging comes into play. Hedging is a strategy designed to protect your portfolio from downside risks while allowing you to pursue long-term growth.

In this article, we'll explore various ways to hedge a long-term investment portfolio and help you better manage risk without losing sight of your financial goals.

What is Hedging?

Hedging is essentially an insurance policy for your investments. It involves taking positions or investing in financial instruments that offset potential losses in your primary portfolio. While hedging can't eliminate risk entirely, it can reduce the impact of short-term volatility and market downturns on your portfolio’s value.

There are multiple strategies to hedge a portfolio, and the right one for you depends on your risk tolerance, investment goals, and market outlook.

Diversification: The Foundation of Hedging

The simplest and most effective way to hedge a long-term investment portfolio is through diversification. Diversification involves spreading your investments across different asset classes, industries, and geographic regions. By doing so, you reduce the risk of any single investment or sector causing significant harm to your overall portfolio.

Key Areas to Diversify:

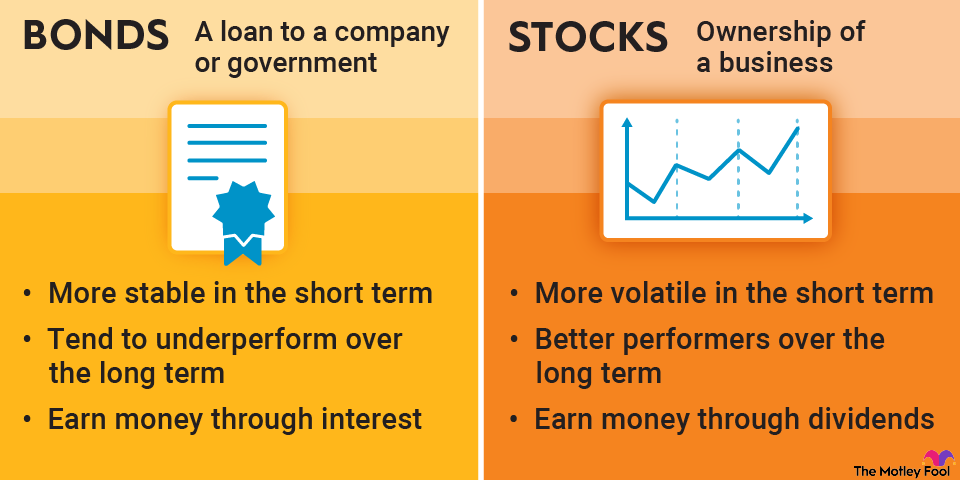

Asset classes: Invest in a mix of stocks, bonds, real estate, and commodities. For example, bonds tend to perform well when stocks decline, helping balance your portfolio.

Geography: Consider exposure to international markets in addition to domestic ones to reduce the impact of localized economic downturns.

Sectors: Spread your investments across various sectors such as technology, healthcare, energy, and consumer staples to avoid being overly reliant on one.

While diversification doesn’t eliminate risk, it smooths out volatility and reduces the likelihood of a severe portfolio decline in a particular asset class or region.

Options Contracts: A Direct Hedging Tool

Options can be a powerful tool for protecting your long-term investments. There are two main types of options you can use to hedge: put options and covered calls.

Put Options: Buying a put option gives you the right to sell an asset at a specific price within a certain time frame. This can be useful when you believe that the value of an asset may drop, as it allows you to sell at a price higher than the market value during a downturn.

For example, if you own a stock and are concerned about a short-term decline, buying a put option can lock in a sell price, limiting your losses while still benefiting from long-term growth potential.

Covered Calls: If you own a large quantity of a particular stock, you can sell call options on it. While this caps the upside potential, it generates additional income from the option premiums, providing a buffer during market downturns.

Options hedging requires a deeper understanding of options markets and risks, so it's often best to start with small positions or consult a financial advisor.

Inverse ETFs: Betting Against the Market

Inverse exchange-traded funds (ETFs) are designed to move in the opposite direction of an underlying index or asset class. When the market declines, these funds increase in value, providing a hedge against a falling portfolio.

For example, if you own a portfolio heavily weighted in the S&P 500, you could buy an inverse S&P 500 ETF to protect against a potential market downturn. Inverse ETFs offer a relatively simple way to hedge without getting involved in complex financial instruments like options.

However, it’s important to note that inverse ETFs are generally more suitable for short-term hedging rather than long-term portfolio protection. Over extended periods, inverse ETFs can lose value due to the compounding effect and the costs associated with daily rebalancing.

Gold and Commodities: A Hedge Against Inflation and Market Volatility

Gold and other commodities like oil or agricultural products can serve as hedges, particularly against inflation and geopolitical uncertainty. Gold is often seen as a safe-haven asset, rising in value when stocks and bonds are underperforming, particularly during times of economic turmoil or inflationary pressures.

Adding a small allocation to commodities, particularly gold, can help protect your portfolio during periods of rising inflation or global instability. However, commodities tend to be more volatile than stocks or bonds, so it’s crucial to maintain a balanced approach.

Bonds: The Classic Hedge

Bonds, particularly government bonds, are a tried-and-true method of hedging a stock-heavy portfolio. Bonds generally have an inverse relationship with stocks, meaning when stock markets decline, bond prices often rise. This is particularly true for U.S. Treasuries, which are considered among the safest investments in the world.

Allocating a portion of your portfolio to bonds, especially long-term government bonds, can cushion your portfolio during stock market corrections or crashes.

TIPS (Treasury Inflation-Protected Securities): These are U.S. government bonds that adjust with inflation. They offer a hedge against inflation eroding the value of your portfolio over time.

Cash: The Ultimate Defensive Asset

Holding cash or cash equivalents (such as money market funds) is one of the simplest ways to hedge a portfolio. While cash doesn’t earn much in terms of returns, it offers liquidity and stability. Having cash on hand also allows you to take advantage of buying opportunities during market downturns, which is a key aspect of long-term investing.

Bitcoin: A Hedge Against Traditional Financial Systems

In recent years, Bitcoin has emerged as a potential hedge against both inflation and traditional financial markets. While it is still considered highly speculative due to its volatility, Bitcoin and other cryptocurrencies are often viewed as a store of value that is independent of government-controlled monetary systems.

How Bitcoin Can Hedge Your Portfolio

Inflation Protection: Bitcoin is sometimes referred to as "digital gold" because of its limited supply, with only 21 million coins that will ever exist. This scarcity, coupled with increasing institutional adoption, has led many investors to consider Bitcoin as a hedge against inflation, much like gold. As central banks around the world print more money, Bitcoin’s capped supply can potentially protect purchasing power over time.

Decentralization: Bitcoin operates outside traditional financial systems, offering a hedge against geopolitical risks, currency devaluation, and systemic risks tied to centralized banks and governments. During periods of uncertainty or loss of confidence in fiat currencies, Bitcoin has historically attracted more attention from investors looking for an alternative asset.

Portfolio Diversification: Bitcoin’s price movements often do not correlate strongly with traditional assets such as stocks or bonds, making it a valuable tool for diversification. Adding Bitcoin to a long-term portfolio may reduce overall volatility if used in small, calculated amounts.

Risks of Bitcoin as a Hedge

While Bitcoin offers a compelling narrative as a hedge, it comes with significant risks:

Volatility: Bitcoin is known for its sharp price swings, which can lead to both rapid gains and significant losses in a short period. It’s important to allocate only a small percentage of your portfolio to Bitcoin, especially in the context of hedging.

Regulatory Uncertainty: Governments around the world are still grappling with how to regulate cryptocurrencies. Future regulations could impact Bitcoin’s value and its role in a portfolio.

Security Risks: Bitcoin ownership requires careful handling of private keys and digital wallets. Investors must ensure they use secure methods to store and manage their holdings to avoid theft or loss.

Bitcoin Allocation in a Hedging Strategy

For long-term investors, a prudent approach would be to allocate a small portion of their portfolio (e.g., 1-5%) to Bitcoin or other cryptocurrencies. This allows you to benefit from its potential upside and hedging properties without exposing your portfolio to excessive risk. Over time, this allocation can provide a hedge against currency debasement and serve as a diversification tool.

Final Thoughts: Balancing Growth and Protection

Hedging a long-term investment portfolio is about balance. You want to protect your wealth from downside risk without sacrificing the potential for growth. A mix of strategies—such as diversification, options, inverse ETFs, bonds, and commodities—can help you hedge your portfolio in a way that suits your risk tolerance and financial goals.

Remember, no hedge is foolproof, and every strategy comes with its trade-offs. The key is to remain disciplined and to adjust your hedging strategies as your portfolio grows and market conditions evolve. With the right approach, you can safeguard your long-term investments while still positioning yourself for financial success.