Alphabet Inc. (Google): A Deep Dive into a Tech Giant's Growth Potential

Alphabet Inc., the parent company of Google, continues to assert itself as a formidable force in the tech industry. With its robust financials, innovative technologies, and strategic growth initiatives, Alphabet is well-positioned to capitalize on the future of technology. In this article, we’ll explore several key areas that highlight why Google remains an attractive investment for those seeking exposure to future tech and long-term growth.

AI and Future Tech: Leading the Way

Artificial Intelligence (AI) is at the core of Alphabet’s strategy. The company’s advancements in AI and machine learning are not just incremental; they are transformative, setting the stage for future growth across various industries.

Google’s AI technologies are deeply integrated into its ecosystem, from search algorithms and ad targeting to more advanced applications like autonomous vehicles and healthcare. Google's AI, such as the language model BERT, has revolutionized search engine capabilities, making search results more relevant and contextually accurate.

Moreover, Alphabet's subsidiary DeepMind continues to push the boundaries of AI research, with developments that could revolutionize fields like drug discovery and climate modeling. The potential applications of AI are vast, and with Google leading the charge, the company is poised to benefit significantly as these technologies become increasingly vital in sectors like finance, healthcare, and logistics.

Growing Cloud Business: A Rising Star

Google Cloud is emerging as a major player in the cloud computing space, an industry that is expected to see exponential growth in the coming years. As businesses continue to migrate their operations to the cloud, Google Cloud’s robust infrastructure, data analytics capabilities, and machine learning tools are becoming increasingly attractive.

In 2024, Google Cloud reported strong revenue growth, driven by increased adoption across sectors such as retail, finance, and healthcare. The cloud division's strategic focus on AI-powered solutions and its commitment to sustainability (with a goal to operate entirely on carbon-free energy by 2030) are key differentiators in a competitive market.

Google Cloud's partnerships with major corporations, as well as its emphasis on hybrid and multi-cloud solutions, further enhance its growth prospects. The increasing reliance on cloud services, coupled with Google’s technological expertise, positions Google Cloud as a significant growth driver for Alphabet’s overall revenue.

Financial Strength: A Fortress Balance Sheet

Alphabet's financial strength is another compelling reason to consider Google as a long-term investment. The company boasts one of the most robust balance sheets in the tech industry, with $100.72 billion in cash and cash equivalents and minimal debt. This financial stability provides flexibility for strategic investments, research and development, and shareholder returns.

This financial stability is particularly valuable in times of economic uncertainty. Alphabet's ability to weather downturns and continue investing in high-growth areas—such as AI, cloud computing, and autonomous vehicles—ensures that it remains competitive and innovative.

Moreover, Alphabet's strong cash flow generation allows it to engage in share repurchases, enhancing shareholder value. The company’s consistent ability to generate free cash flow, even as it invests heavily in future technologies, underscores its financial discipline and operational efficiency.

Commitment to Innovation: Staying Ahead of the Curve

Innovation is the lifeblood of Alphabet, and the company’s relentless focus on pushing the boundaries of what’s possible sets it apart from its competitors. From autonomous vehicles with Waymo to cutting-edge developments in quantum computing, Alphabet is exploring new frontiers that could redefine entire industries.

Waymo, Alphabet’s self-driving car subsidiary, is at the forefront of autonomous vehicle technology. With millions of miles driven in autonomous mode, Waymo is widely regarded as a leader in the field. The potential for autonomous vehicles to disrupt transportation and logistics is enormous, and Waymo’s progress could translate into significant long-term value for Alphabet.

In addition to Waymo, Alphabet’s ventures into quantum computing through Google Quantum AI could revolutionize problem-solving across industries. Quantum computers have the potential to perform calculations that are impossible for classical computers, opening up new possibilities in fields like cryptography, materials science, and complex system simulations.

Via Survey Point

Attractive Valuation: A Reasonable Entry Point

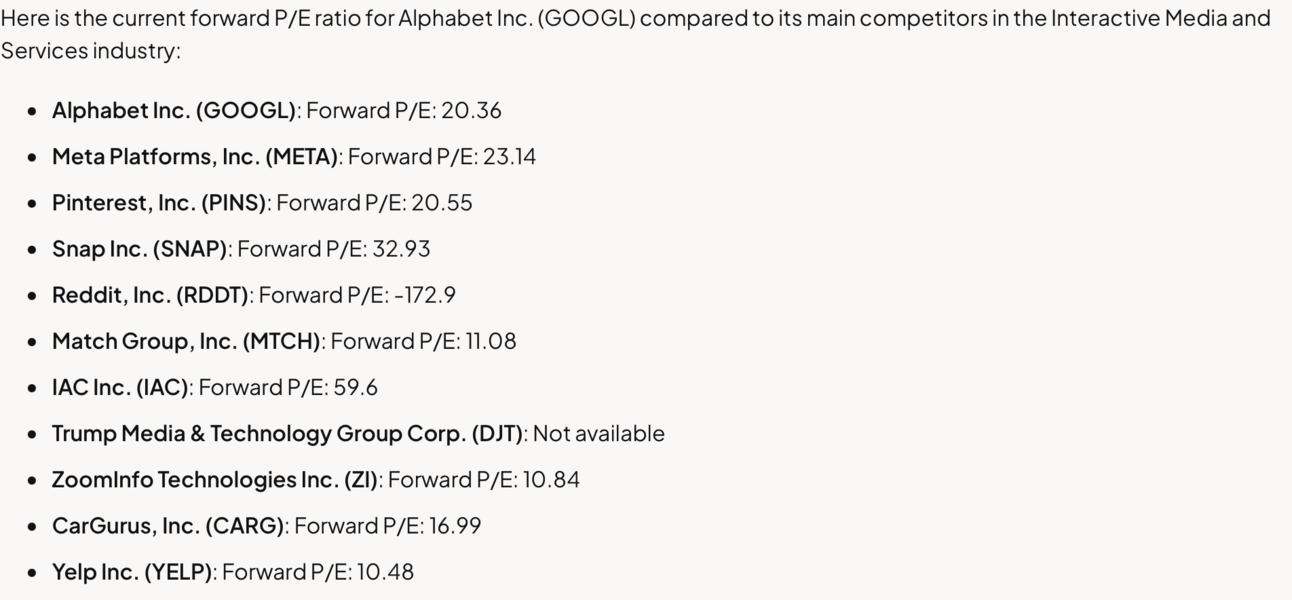

Despite its market leadership and strong growth prospects, Google is trading at a forward price-to-earnings (P/E) ratio of just 21. This relatively modest valuation, given Alphabet's substantial growth potential, presents a compelling opportunity for investors.

Investors often pay a premium for market leaders, especially those with a proven track record of innovation and financial stability. However, Alphabet’s diversified revenue streams, from its core advertising business to its burgeoning cloud division, coupled with its investments in future technologies, justify its valuation.

For investors looking to gain exposure to a tech giant with substantial long-term potential, Google offers a compelling opportunity. The company’s ability to generate consistent revenue growth, its commitment to innovation, and its strong financial position make it a cornerstone investment in any technology-focused portfolio.

Via Finchat.io

Technical Analysis done by Market Victor

Valuation: What is Google Worth per Share?

Current estimated fair value: $194

Market Victor’s fair value estimate was calculated using a combination of several methods including a Discounted Cash Flow model with margins of safety based on the underlying company’s business and stock performance.

Chart Analysis

Google has been in a long-term uptrend since May 2023, as indicated by key technical signals on its daily chart:

The 50 SMA is above the 150 SMA, with both sloping upward.

The price is above the 200 SMA, which is also trending upward.

As long as these technical conditions hold, any dips in Google could present potential buying opportunities for investors.

The 200 SMA is one of the most reliable technical levels for buying opportunities, and Google responded well when it touched this level in March 2024.

But what if Google dips below the 200 SMA on the daily chart?

In that case, we can apply the same technical levels on the weekly chart. As you can see, Google has consistently found support at the 50 SMA and 150 SMA during bull markets, with the 200 SMA acting as support during the bear markets of 2020 and 2022.

By using the SMAs on both daily and weekly charts, we can identify the following potential buy levels for Google:

$162 - The 150 SMA on the daily chart (current price level)

$156 - The 200 SMA on the daily chart

$152 - The 50 SMA on the weekly chart

$129 - The 150 SMA on the weekly chart

$125 - The 200 SMA on the weekly chart

As an investor, you can use these levels to create an investment plan, buying when the price hits your desired level. It’s worth noting that all these levels are below Google’s fair value of $194.

How low can it go?

Analyzing the short-term trend can be helpful in timing your entries into a long-term position more effectively.

Currently, Google is in a short-term downtrend, as indicated by the 20 EMA being below the 40 EMA. Given this downtrend, it’s reasonable to anticipate that Google might reach the lower price targets mentioned above.

Once the price closes above the 20 and 40 EMAs and they cross bullish, you can expect prices to move higher, allowing you to complete your investment plan at the nearest support level.

Conclusion: A Tech Giant Poised for the Future

Alphabet Inc. stands out as a tech giant that is not only shaping the present but also positioning itself for future success. With its advancements in AI, growing cloud business, financial strength, and unwavering commitment to innovation, Google remains a top choice for investors seeking long-term growth in the tech sector. As the company continues to navigate a competitive landscape and explore new growth avenues, Alphabet's potential to deliver strong returns remains as compelling as ever.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in stocks involves risks, including the potential loss of principal. Always conduct your own research and consult with a financial advisor before making any investment decisions. The opinions expressed in this article are those of the author and do not necessarily reflect the views of Ashton Invests or its affiliates.